All Categories

Featured

Table of Contents

The disadvantages of boundless financial are often neglected or not mentioned in all (much of the info available regarding this principle is from insurance policy representatives, which might be a little biased). Only the cash money worth is expanding at the returns rate. You also need to pay for the price of insurance, costs, and costs.

Companies that supply non-direct recognition lendings may have a lower dividend rate. Your money is secured into a complicated insurance coverage item, and abandonment charges usually don't disappear till you have actually had the plan for 10 to 15 years. Every long-term life insurance coverage plan is different, but it's clear someone's overall return on every dollar spent on an insurance policy item can not be anywhere near to the returns price for the plan.

Self Banking Whole Life Insurance

To provide a really standard and theoretical instance, allow's assume someone has the ability to earn 3%, generally, for every single dollar they invest on an "boundless financial" insurance policy item (nevertheless costs and fees). This is double the approximated return of whole life insurance policy from Customer Reports of 1.5%. If we assume those bucks would certainly be subject to 50% in taxes complete if not in the insurance product, the tax-adjusted price of return could be 4.5%.

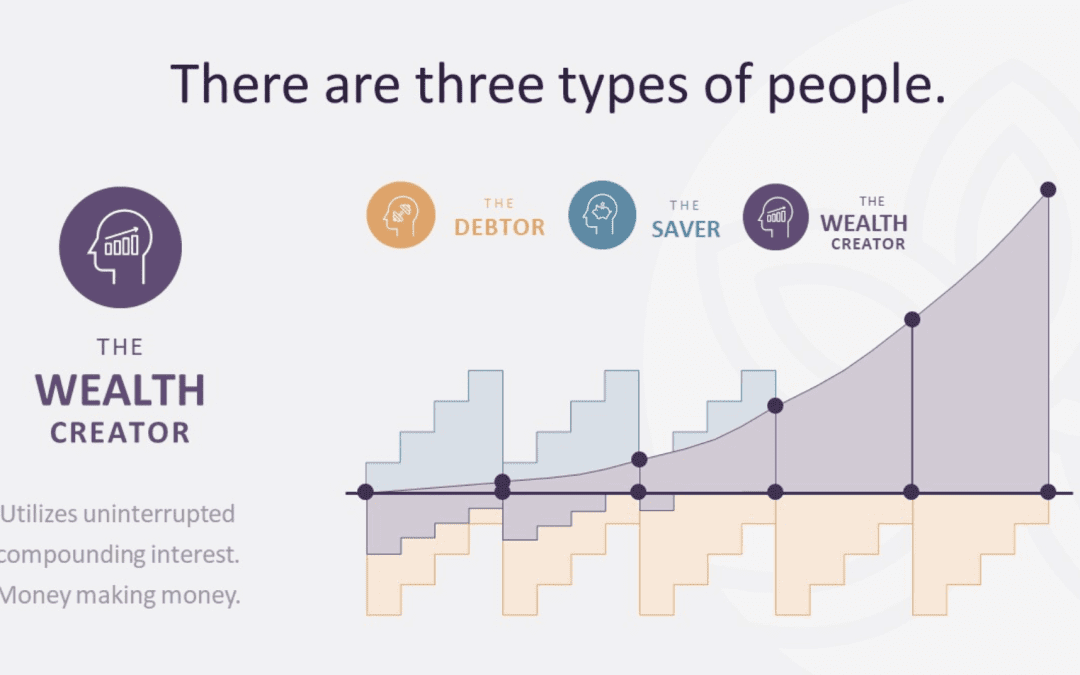

We think greater than average returns overall life product and a really high tax obligation rate on dollars not place right into the plan (which makes the insurance item look much better). The truth for several people might be worse. This pales in contrast to the long-term return of the S&P 500 of over 10%.

Limitless banking is an excellent product for representatives that sell insurance policy, but might not be optimum when contrasted to the cheaper choices (without sales individuals gaining fat compensations). Here's a failure of a few of the other supposed advantages of infinite banking and why they might not be all they're cracked up to be.

Alliance Bank Visa Infinite

At the end of the day you are buying an insurance product. We love the protection that insurance coverage uses, which can be acquired a lot less expensively from a low-cost term life insurance policy policy. Unsettled loans from the plan might also lower your survivor benefit, lessening an additional degree of security in the policy.

The concept just works when you not only pay the significant costs, but make use of additional cash money to buy paid-up additions. The opportunity cost of all of those bucks is remarkable extremely so when you could rather be buying a Roth IRA, HSA, or 401(k). Even when contrasted to a taxed investment account and even a financial savings account, limitless financial may not provide similar returns (compared to investing) and comparable liquidity, access, and low/no cost framework (contrasted to a high-yield cost savings account).

With the surge of TikTok as an information-sharing system, monetary suggestions and approaches have actually found a novel means of spreading. One such method that has been making the rounds is the unlimited financial principle, or IBC for brief, garnering endorsements from celebrities like rap artist Waka Flocka Fire. However, while the technique is currently prominent, its origins map back to the 1980s when economist Nelson Nash introduced it to the globe.

Within these policies, the cash worth expands based upon a rate established by the insurance firm. As soon as a substantial cash worth accumulates, insurance holders can get a money worth financing. These fundings vary from traditional ones, with life insurance coverage working as security, indicating one might shed their coverage if borrowing excessively without ample cash money value to sustain the insurance policy costs.

Infinite Banking Examples

And while the attraction of these policies appears, there are innate constraints and risks, demanding diligent cash money worth monitoring. The strategy's legitimacy isn't black and white. For high-net-worth people or entrepreneur, particularly those utilizing approaches like company-owned life insurance coverage (COLI), the benefits of tax breaks and compound growth could be appealing.

The attraction of unlimited banking doesn't negate its obstacles: Expense: The fundamental need, a long-term life insurance policy, is costlier than its term counterparts. Qualification: Not every person gets whole life insurance coverage because of rigorous underwriting procedures that can omit those with certain health and wellness or lifestyle problems. Complexity and threat: The detailed nature of IBC, paired with its risks, might hinder many, especially when simpler and much less risky choices are offered.

Allocating around 10% of your month-to-month income to the plan is simply not possible for many individuals. Component of what you review below is just a reiteration of what has currently been said over.

Prior to you obtain yourself into a situation you're not prepared for, recognize the adhering to initially: Although the idea is typically marketed as such, you're not in fact taking a funding from yourself. If that held true, you wouldn't have to repay it. Rather, you're borrowing from the insurance firm and need to settle it with interest

Infinite Banking

Some social media messages recommend making use of cash money worth from whole life insurance policy to pay down credit history card financial debt. When you pay back the loan, a part of that rate of interest goes to the insurance firm.

For the initial numerous years, you'll be settling the payment. This makes it extremely tough for your policy to gather worth throughout this moment. Entire life insurance policy expenses 5 to 15 times more than term insurance policy. The majority of people just can't manage it. Unless you can pay for to pay a few to a number of hundred dollars for the following decade or even more, IBC will not function for you.

If you require life insurance coverage, below are some useful suggestions to think about: Take into consideration term life insurance. Make sure to go shopping around for the finest price.

Boundless financial is not an item or service supplied by a particular institution. Unlimited financial is a method in which you get a life insurance coverage plan that accumulates interest-earning money worth and secure finances versus it, "borrowing from on your own" as a resource of capital. Ultimately pay back the lending and start the cycle all over again.

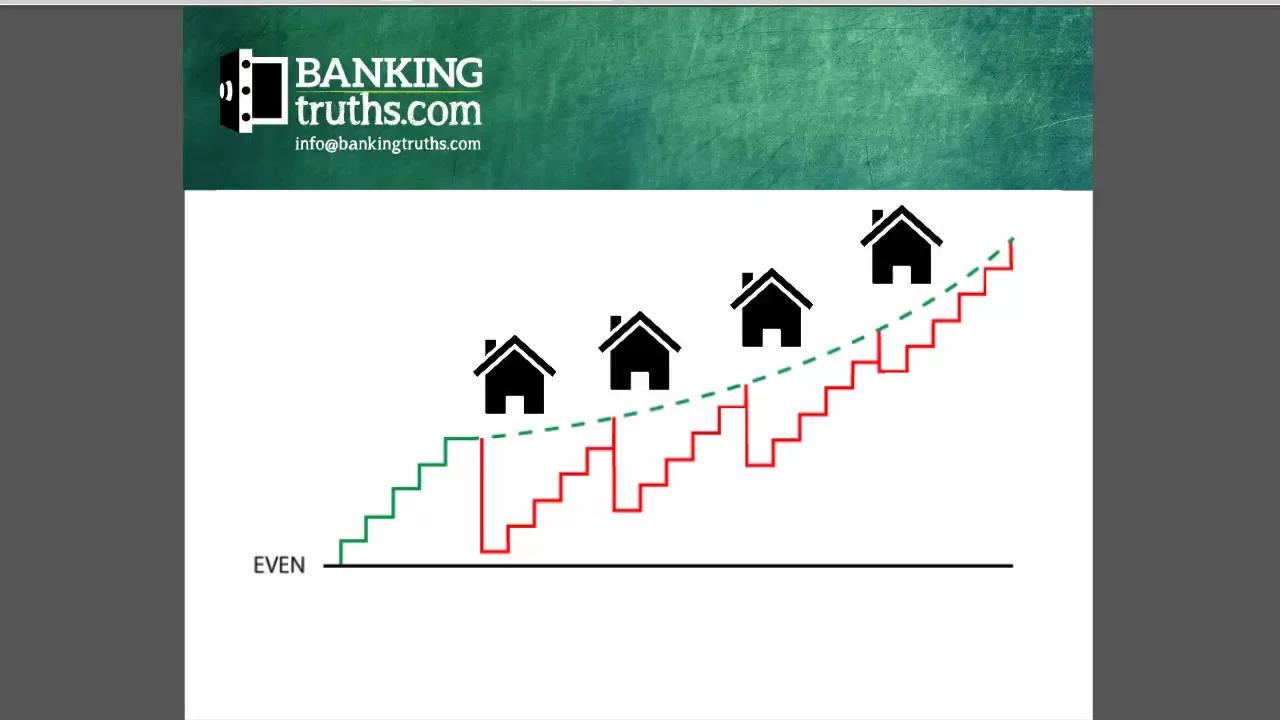

Pay policy costs, a part of which builds money value. Cash money worth gains worsening interest. Take a car loan out versus the policy's cash money value, tax-free. Settle lendings with interest. Cash value accumulates once more, and the cycle repeats. If you use this principle as meant, you're taking money out of your life insurance policy plan to purchase whatever you would certainly require for the rest of your life.

Latest Posts

Be Your Own Bank - Infinite Growth Plan

How To Be Your Own Bank

Bank On Yourself Program